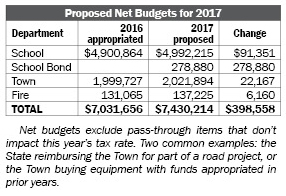

The Andover Budget Committee recommendation for the 2017 budgets (net of appropriations that are funded by non-tax sources) total $7,430,214, an increase over 2016 of $398,598. This is an increase of 5.7%, and will add approximately $1.58 to the tax rate.

About 93% of this increase comes from the increase in the School budget due primarily to the proposed bond for renovations. About 7% comes from increases in the Town and Fire budgets.

An Andover property assessed at $200,000 will probably see an increase in their tax bill for 2017 of about $316.

Andover School Budget

Andover School Budget

The Budget Committee recommends an operating budget for the Andover School District for fiscal year 2017-18 of $4,992,215. This is up $91,351 (1.9%) over the previous year. This will increase the tax rate by approximately $0.36 per thousand dollars of valuation. A property assessed at $200,000 will see an increase of $72 in its tax bill for 2017 over 2016.

In addition, the Budget Committee also recommends approval of a bond for $3.6 million for major improvements to the school building. This requires an appropriation of $277,880 for the first year payment on a 15-year bond. This will increase the tax rate a further $1.10, and add $220 to the 2017 tax bill of a $200,000 property.

During successive years of the bond, the debt service payments will average $290,000 each year. On average, this expense will add $1.16 to the tax rate, and will add $232 to the tax bill each year for a $200,000 property.

The Budget Committee does not recommend approval of a petitioned warrant article. This article proposes an appropriation of $5,000 to study the budgetary and scholarly implications of tuitioning our middle-school pupils to the Merrimack Valley School District, and seeks to delay implementation of the school building project until the results of this study are available.

The Committee is concerned that a suitable in-depth study would likely cost more and take more time than has been estimated. And delaying the implementation of the recommended building project would incur additional inappropriate costs.

Andover Town Budget

The recommended 2017 operating budget for the Town is $1,636,918. This is an increase over the 2016 operating budget by $24,014 (1.5%).

The Morrill Hill bridge replacement is finally scheduled for completion and requires an appropriation of the full cost of the project of $620,000. A warrant article proposes to fund this appropriation with funds from a Capital Reserve Fund and from the Unassigned Fund Balance.

Ultimately, after reimbursements from the State, the cost to Andover is expected to be only $124,000. No tax funds will be required at this time for this project.

After extensive analysis and planning, the Town proposes some significant improvements in the Town Hall’s heating and cooling system, including installation of solar panels. The cost to implement this plan is $17,000, to be funded from an existing Capital Reserve Fund and the Unassigned Fund Balance. No tax funds will be required.

It is proposed to place $2,954 each year for six years into an Expendable Trust Fund to provide for the possible execution of an option to purchase the solar panel system. These funds will come from the Unassigned Fund Balance. No tax funds will be required.

It is proposed to establish a contingency fund of $10,000 for unexpected Town expenses, to be funded from the Unassigned Fund Balance. Any unused funds would revert to the General Fund at the end of the year. No tax funds will be required.

The Budget Committee recommends approval of all of these warrant articles.

The following other warrant articles totaling $369,976 will add amounts to established Capital Reserve Funds (CRF) and Expendable Trust Funds (ETF) and are recommended by the Budget Committee:

- $10,476 to Revaluation CRF

- $25,000 to Ambulance CRF

- $15,000 to Highway Grader CRF

- $150,000 to Highway Projects CRF

- $13,500 to Police Cruiser CRF

- $10,000 to Transfer Station Equipment CRF

- $115,000 to Bridge Rehab CRF; this includes $65,000 for removal of the Gale Road bridge

- $5,000 to Fire Emergency Labor ETF

- $20,000 to Town Buildings ETF

- $6,000 to Technology ETF

Two warrant articles propose alternate funding to install fencing at the Lakeview Cemetery in East Andover. The Budget Committee recommends the second plan, to establish a CRF to be funded for two successive years, with a funding this year of $15,000. Since there is no time pressure for this project, spreading the cost over two years is appropriate.

The Budget Committee does not recommend approval of the warrant article that proposes shifting the funding of the Andover Fourth of July celebration from volunteer contributions to tax funding. The Committee sees the annual celebration as a community-wide event with wide participation and support. Changing to tax funding would institutionalize the festival.

A petitioned warrant article proposes the purchase of highway equipment. The details of this article have not been available to the Budget Committee at the time of writing.

The total recommended Town net budget for 2017 is $2,021,894. This is up $22,167 (1.1%) over last year’s net appropriation, and would add an estimated $0.09 to the tax rate.

Andover Fire Departments

The recommended 2017 budget for the two Andover Fire Districts is $137,225. This is up $6,160 (4.7%) over the appropriations for the previous year.