![]() The Andover Budget Committee recommends a 2014 budget for the Andover School District of $4,704,553, up $88,597 over last year’s appropriation. The recommended budget for the Town, net of directly offsetting revenues, is $1,637,331, up $148,188 over last year’s net appropriation. The recommended budgets for the two Fire Departments total $106,624, the same as last year. Assuming that the charge to the Town from Merrimack County remains the same as last year at $752,807, the recommended total net budget for 2014 is $7,215,365, up 3.4% over last year.

The Andover Budget Committee recommends a 2014 budget for the Andover School District of $4,704,553, up $88,597 over last year’s appropriation. The recommended budget for the Town, net of directly offsetting revenues, is $1,637,331, up $148,188 over last year’s net appropriation. The recommended budgets for the two Fire Departments total $106,624, the same as last year. Assuming that the charge to the Town from Merrimack County remains the same as last year at $752,807, the recommended total net budget for 2014 is $7,215,365, up 3.4% over last year.

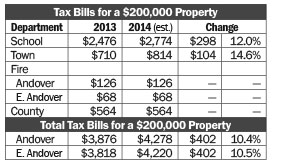

Revenues that will offset the tax impact of these budget recommendations are predicted to be significantly lower. As a result, the estimated tax rate for 2014 is above the rate for 2013 by about 10%.

Andover School Budget

The Budget Committee recommends an operating budget for the School for fiscal year 2014-15 of $4,654,533. The Committee also recommends approval of Warrant Article 7 for $50,000 to fund a building maintenance and improvement study. The total recommended budget is $4,704,553. This is an increase of $88,597 (1.9%) over the appropriation for 2013-14.

Last year there was an unexpended surplus of $309,095 that was used to reduce the tax burden. This year there is little likelihood of any significant surplus. Assuming that other revenues remain the same as last year, the tax burden for the School District is estimated to be up $397,692, or 12.1%. This will add $1.49 to the tax rate for 2014. Any unexpended surplus from the current year will be applied to reduce this tax burden.

![]() The Committee recommends approval of Warrant Article 5, to authorize the School Board to transfer up to $25,000 from unexpended surplus from the previous fiscal year into the High School Tuition Trust Fund. Also recommended is approval of Warrant Article 6, to authorize transfer of up to $25,000 from unexpended surplus into the Special Education Trust Fund.

The Committee recommends approval of Warrant Article 5, to authorize the School Board to transfer up to $25,000 from unexpended surplus from the previous fiscal year into the High School Tuition Trust Fund. Also recommended is approval of Warrant Article 6, to authorize transfer of up to $25,000 from unexpended surplus into the Special Education Trust Fund.

The Committee also recommends approval of Warrant Article 8, to establish a Contingency Fund to meet the cost of emergency expenses that may arise, and authorizes the School Board to transfer into this Fund amounts from unexpended surplus each year. By law, the total amount in this Fund cannot exceed 2.5% of the year’s net tax assessment (this year that limitation is approximately $90,000).

These three Warrant Articles will be funded, at the discretion of the School Board, from unexpended surplus. To the extent that any funds are utilized for these purposes, that will reduce the amount of surplus available as revenue to reduce taxes. Conservatively estimating that there will be no unexpended surplus available at the end of fiscal year 2013-14 to provide funding for these Articles, there will be no reduction on the tax burden for fiscal year 2014-15. However, any unexpended surplus that is used to fund these articles will have a direct impact on the tax rate.

Andover Town Budget

The recommended 2014 net budget for the Town including warrant articles (less all directly offsetting revenues) is $1,637,331. This up from the net appropriation for 2013 by $148,188 (10.0%).

The areas seeing the largest increases in budgeted spending for the coming year are: Highways and Bridges operations: up $58,700; Highway Projects: up $58,000; Town Office: up $49,865

Town revenues in 2014 are predicted to be down from the amounts received in 2013. The amount to be raised by taxes to fund the recommended Town budget is predicted to be $1,089,162, up $139,352 (14.7%) from last year’s amount. This will result in an estimated increase in the tax rate by $0.52.

Andover Fire Departments

The 2014 budget recommendation for the Andover Fire District is $67,362, and for the East Andover Fire precinct is $53,312, for a total of $120,674. These budgets are the same as the appropriations for 2013.

Estimated Tax Rates

Estimated Tax Rates

Prediction of the impact that these recommended budget increases will have on the property tax rate for 2014 requires estimates of the other revenues that reduce the tax burden. It appears now that these revenues will be significantly less in 2014 than they were in 2013. In particular, there is no unexpended surplus available from the 2013 School appropriation, whereas last year there was $309,095 available to offset taxes.

Based on reasonable estimates of other revenues, the total Andover tax rate for 2014 is predicted to increase by about 10.5%. The tax bill for a property in the East Andover Fire District valued at $200,000 will be approximately $4,220, up $402 from the $3,818 of 2013. Similar amounts are estimated for a property in the Andover fire district.